Corporate Bankruptcy in Canada

If your business is facing too much debt, corporate bankruptcy or a Division I Proposal can help. These legal options let you either close your business or restructure debt so you can keep operating while managing outstanding debts and improving business cash flow.

What is Corporate Bankruptcy?

Corporate bankruptcy is a legal process that helps businesses eliminate debt when they can’t pay what they owe. It is governed by the Bankruptcy and Insolvency Act (BIA) in Canada. There are two types:

- Voluntary Bankruptcy – Business owners file for bankruptcy and give control of company’s assets to a Licensed Insolvency Trustee (LIT).

- Involuntary Bankruptcy – Creditors take legal action to force the company into bankruptcy through a court-appointed receivership.

When Should a Business Consider Bankruptcy?

A business should consider corporate bankruptcy if:

- It cannot pay its bills or meet monthly payments.

- Creditors are taking legal action or threatening to seize assets.

- The company has no way to recover financially.

- Business debts are greater than business assets.

- It faces CRA collection actions or overdue tax obligations.

- It has exhausted other business restructuring options and needs a fresh start.

How the Corporate Bankruptcy Process Works

Step 1: Meet with a Licensed Insolvency Trustee (LIT)

A Licensed Insolvency Trustee (LIT) reviews your financial situation, explains your options, and helps decide if bankruptcy is best.

Step 2: Filing for Bankruptcy

Once the bankruptcy is filed with the Office of the Superintendent of Bankruptcy (OSB), creditors must stop collection efforts immediately due to the Stay of Proceedings.

Step 3: Selling Business Assets

The LIT manages the sale of the company’s assets to repay creditors. Secured creditors get paid first, and remaining debts may be forgiven after liquidation.

Step 4: Business Closure

Once the process is complete, the company stops operating, and debts are wiped out, giving the business owner a fresh start.

What is a Division I Proposal?

A Division I Proposal is a legal plan that allows a company to restructure its debt while continuing operations. It provides an alternative to bankruptcy, enabling businesses to repay a portion of what they owe under revised terms that are acceptable to creditors.

How a Division I Proposal Works

Step 1: Filing a Proposal (or Notice of Intention, if needed)

A business can file a Division I Proposal directly without a prior Notice of Intention (NOI). However, an NOI may be used if there is pending legal action or the company needs additional time to prepare its proposal. Filing an NOI triggers a stay of proceedings, temporarily stopping creditor actions.

- If an NOI is filed, the company must submit a formal proposal within 30 days or apply to the court for an extension. Otherwise, the company is automatically deemed bankrupt.

Step 2: Creating a Restructuring Plan

With the guidance of a Licensed Insolvency Trustee (LIT), the business develops a repayment plan that may include:

- Lump sum payments to creditors

- Lower monthly payments over time

- Debt-to-equity conversion

- Selling non-essential assets

- Renegotiating payment terms with creditors

Step 3: Creditor Approval

For the proposal to proceed, creditors must approve it by a two-thirds majority of the total debt and a simple majority of creditors. If approved, the court provides final approval, and the business follows the agreed-upon repayment terms.

If the proposal is rejected, the company is automatically placed into bankruptcy.

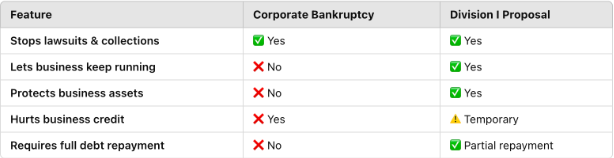

Corporate Bankruptcy vs. Division I Proposal: Key Differences

Case Study: How a Division I Proposal Saved a Business

The Challenge

A mid-sized construction company in Vancouver faced severe financial hardship due to outstanding debts and legal action from creditors. With limited cash flow and declining contracts, the company was at risk of shutting down.

The Solution

The business consulted a Licensed Insolvency Trustee (LIT) who recommended a Division I Proposal to avoid corporate bankruptcy. The LIT guided the company through filing a Notice of Intention (NOI) to immediately stop creditor lawsuits and negotiated lower payment terms with major creditors. A portion of the debt was converted into equity, reducing the overall financial burden, while extended payment terms freed up cash flow for new projects. Additionally, credit recovery strategies were implemented to help rebuild financial stability over time.

The Outcome

After approval by creditors, the company successfully reduced its debt load by 40%, secured new contracts with improved cash flow, and continued operations while avoiding bankruptcy. Over the next two years, the company gradually rebuilt its credit rating and avoided business liquidation through a well-structured corporate proposal.

This case highlights how a Division I Proposal can offer a real solution for struggling businesses.

Frequently Asked Questions

Yes, but it takes time. Business owners may need to wait before securing new financing and must carefully manage finances to rebuild trust with creditors.

Many contracts are terminated, but some may be renegotiated depending on the situation.

Some lenders offer alternative financing, but interest rates may be higher.

If the business is incorporated, personal credit is usually unaffected unless there are personal guarantees.

Get Expert Advice on Business Debt Solutions

If your business is in trouble, don’t wait too long. A Corporate Bankruptcy or Division I Proposal may be the best option to protect your bottom line.

Book a Free Consultation with a Licensed Insolvency Trustee today!